What Is The Disability Care Allowance?

Disability Care Allowance is a UK compensatory benefit. It is intended for people who take care of disabled persons for more than 35 hour a week or are caregivers to someone with disabilities. It was introduced as Invalid Care Allowance in 1976. At that time, only married women were eligible for the benefit. This has been expanded to include single parents as well as men. The size of the pool of eligible candidates differs by each local Social Mobility Commission area. A benefit is also available for people over 65.

What Is The Disability Care Allowance?

You can claim benefits for your child’s education, up to the age when he or she is twenty-five. The disabled child will then be able to start receiving the education he or she would not otherwise have. The Social Benefits law allows disabled children to continue with their education even though they cannot continue with the subjects that they studied. You can also claim for the care of your parent while you are studying, or the care of your child during post-study study. These are just a few of many things that Disability Care Allowance covers.

What Is The Disability Care Allowance?

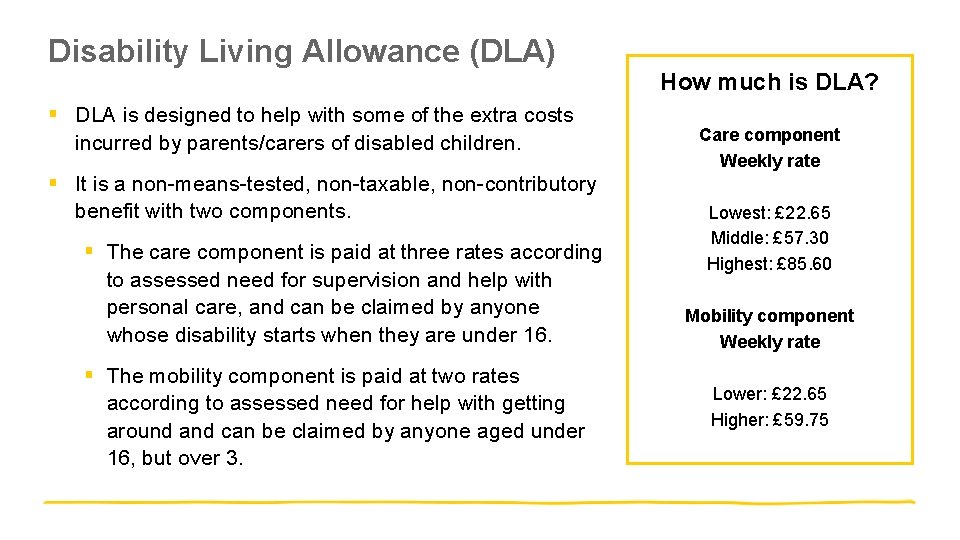

The amount of your invalid care allowance will depend on many factors, including how many children and disabled people you are caring for, the length of time you have been claiming disability care allowance, and how many children you are caring. You can learn more about invalid-care allowance benefits on the SSS site. These are some additional benefits that you can claim when applying for Social Security benefits through the disability care allocation:

The Social Security Administration will cover personal care services that are provided for disabled persons. If you or a child are receiving home-based care and you wish to claim the Disability Care Allowance for this, then this should be included in your claim. Personal care services should also be included if they are provided by or are part a healthcare facility. If your child is receiving inpatient, long term, or home health care, you may be eligible for a Disability Care Allowance.

The Social Security Administration will pay the cost for personal care services. This includes dressing, bathing and eating, as well as taking prescribed medication, socializing with friends, and receiving medical attention. You will need to list the income source from which you receive your disability care allowance. You will need to list all income you have received when you apply for the allowance. When applying for your care disability allowance, any other benefits you receive from the U.S. such as retirement benefits, you don’t have to list them.

An annual capitation benefit is another way the Social Security Administration can pay for your disability care allowance. This benefit can reach as high as $3500 per annum. This amount will depend on your gross monthly income. It will increase each year regardless of your age. When you apply for your care disability allowance, you must declare all income received, federal and private. It is recommended to apply for multiple allowances so you can be sure you are getting the right amount for your reasons.

Many people mistakenly believe that disability benefits will cover funeral expenses. This is false and will not be paid if your death is caused by an accident or a medical condition that you have caused by your job. This applies to most disability benefits. If you believe they will pay for your funeral expenses, the SSA could take legal action against you. Falsely believing your disability benefits will cover funeral costs is a sign that you are not eligible for Social Security Administration money or any other federal agency.

Certain eligibility criteria are required to be eligible for disability retirement benefits. You must be able to earn enough income to support your long-term survival to be eligible for the disability person’s allowance. The supplemental security and social security disability insurance (SSDI), which are the most common disability retirement benefits, are the SSI (supplemental security income) and the SSI (social security disability insurance) payments. Both of these programs offer benefits to disabled persons and require proof to be eligible for them. These benefits increase in value with inflation, and are indefinitely paid until you leave the program.